End-to-end piping solutions provider, ISF Group Berhad (“ISF” or the “Company”) (“杨成群集团”), has successfully launched its prospectus on 8 January 2026 in conjunction with its initial public offering (“IPO”) exercise on the ACE Market of Bursa Malaysia Securities Berhad (“Bursa Securities”).

Alliance Islamic Bank Berhad is the Principal Adviser, Sponsor, Sole Underwriter and Placement Agent for this IPO exercise.

Photo caption (from left to right)

- Ms. Lim Ay Yum (林待妘女士), Executive Director of ISF Group Berhad • Mr. Ai Sew Fuat (杨斯发先生), Executive Director of ISF Group Berhad • Mr. Jeff Ai Boon Chen (杨汶潜先生), Managing Director of ISF Group Berhad • Ms. Yap Chui Fan (叶翠芬女士), Independent Non-Executive Chairperson of ISF Group Berhad

- Ms. Teoh Chu Lin (赵子霖女士), Group Chief Corporate & Institutional Banking Officer of Alliance Bank Malaysia Berhad

- Ms. Lim Shueh Li (林学丽女士), Head / Senior Vice President, Coverage & Origination of Islamic Capital Markets of Alliance Islamic Bank Berhad • Mr. Tee Kok Wah (郑国华先生), Head / Senior Vice President, Corporate Finance, Islamic Capital Markets of Alliance Islamic Bank Berhad

ISF, through its subsidiary, Yeo Plumber Sdn Bhd (collectively known as the “Group”), is principally involved in the supply and installation of piping systems for end-user premises as well as water supply and sewer infrastructure piping. Beyond this, the Group provides maintenance and repair services for piping systems.

Since its commencement of business operations in 2001, the Group began as a trader of plumbing materials. With a proven track record in this business, the Group has undertaken numerous projects, including large-scale projects across a diversified range of end-user premises. These projects span across industrial, data centres, residential, commercial, institutional, healthcare and infrastructure such as power plants and mass transit facilities.

As at 9 December 2025, the Group’s unbilled order book stood at RM120.68 million, mainly comprising RM117.47 million from end-user premises piping projects, with the remaining RM3.21 million from infrastructure piping project. This is expected to provide earnings visibility to the Group up to the financial year ending 31 December 2028.

Managing Director of ISF, Mr. Jeff Ai Boon Chen (杨汶潜先生), said, “The launch of our prospectus is a significant milestone for all of us at ISF. From our beginnings as a small family business, we have steadily grown into a company with a proven track record in executing large-scale and complex piping projects across diverse end-user premises in various states in Peninsular Malaysia.”

“As we look ahead, we see clear opportunities for growth. The IPO will support our key growth plans, including the establishment and expansion of our operational facilities, the development of our existing business activities, and the expansion of our workforce. Together, these initiatives will enable us to scale our operations, strengthen our capabilities, and position us to capture a larger share of the market.”

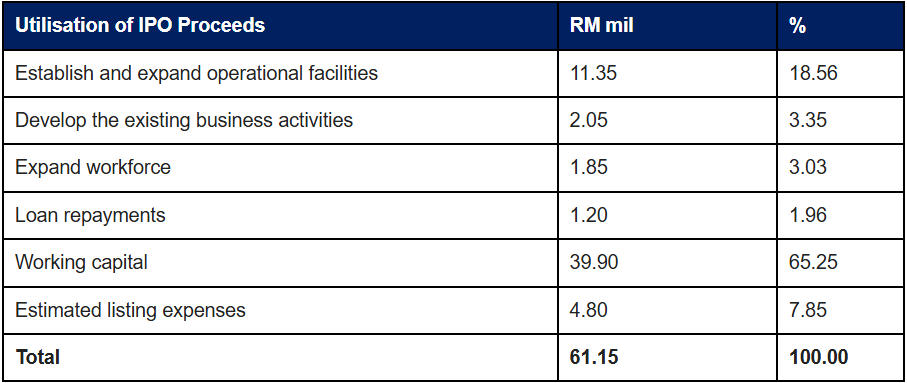

A total of RM61.15 million IPO proceeds is expected to be raised at the IPO price of RM0.33 per share. The intended utilisation of the IPO proceeds is set out in the following manner:

ISF’s IPO exercise entails a public issue of 185.30 million new ordinary shares (“Issue Shares”), representing 18.53% of its enlarged issued share capital, as well as an offer for sale of 90.00 million existing shares (“Offer Shares”), representing 9.00% of its enlarged issued share capital.

Of the 185.30 million Issue Shares, 50.00 million Issue Shares will be made available to the Malaysian public via balloting; 15.00 million Issue Shares will be made available to its eligible directors, employees and persons who have contributed to the success of the Group (“Pink Form Allocation”); 35.00 million Issue Shares will be made available by way of private placement to selected Bumiputera investors approved by the Ministry of Investment, Trade and Industry of Malaysia (“MITI”), while the remaining 85.30 million Issue Shares will be made available by way of private placement to selected investors.

Meanwhile, all 90.00 million Offer Shares will be made available by way of private placement to selected Bumiputera investors approved by the MITI.

On the financial front, the Group’s revenue increased to RM54.67 million in the financial year ended 31 December 2024 (“FYE 2024”) from RM21.57 million in the financial year ended 31 December 2022 (“FYE 2022”), representing a 2-year compound annual growth rate (“CAGR”) of 59.19%. The end-user premises piping

segment accounted for 83.95% of total revenue in FYE 2024, while the infrastructure piping segment contributed 13.75%, with the remaining 2.30% derived from maintenance and repair services.

In line with the top-line growth over the same period, the Group’s profit after tax (“PAT”) rose to RM9.64 million in FYE 2024 from RM0.93 million in FYE 2022, representing a 2-year CAGR of 221.37%. This strong performance continued into the 7-month financial period ended 31 July 2025 (“FPE 2025”), where the Group recorded revenue of RM59.52 million and a PAT of RM15.18 million.

According to the Independent Market Research Report by Vital Factor Consulting Sdn Bhd, government allocations under Budget 2026 are expected to support continued demand for potable water and sewer piping infrastructure in residential developments. These include allocations of RM672.00 million for the Projek Residensi Rakyat developments and Rumah Mesra Rakyat projects, and RM100.00 million for the construction of Program Residensi MADANI, which are aimed at promoting home ownership.

In addition, Malaysia’s data centre industry is projected to grow at a CAGR of 22.40% between 2025 and 2030, reaching RM59.60 billion by 2030. This growth is underpinned by the government’s continued commitment to advancing Malaysia’s digital infrastructure.

Upon listing, the Group will have a market capitalisation of RM330.00 million, based on its enlarged issued share capital of 1.00 billion shares and IPO price of RM0.33 per share.

Following the prospectus launch, applications for the public issue are open from today and will be closed at 5.00pm on 14 January 2026. ISF is scheduled to be listed on the ACE Market of Bursa Securities on 28 January 2026.

About ISF Group Berhad

Based in Johor, ISF Group Berhad, via its subsidiary (collectively, known as the “Group”) is principally involved in the supply and installation of piping systems for end user premises as well as water supply and sewer infrastructure piping. The Group also provides maintenance and repair services for piping systems.

Through its indirect distribution channel, the Group serves, among others, main contractors, project management companies, and mechanical and engineering contractors, while its direct distribution channel serves business owners, property owners, and property developers. Its projects cover industrial, data centre, residential, commercial, institutional, healthcare, and infrastructure such as power plants and

mass transit facilities sectors, supporting a strong market presence and nationwide footprint across Peninsular Malaysia.

For more information, please visit https://isf.com.my/