Solar photovoltaic (“solar PV”) system company, JS Solar Holding Berhad (“JS Solar”), has successfully launched its prospectus in conjunction with its initial public offering (“IPO”) exercise on the ACE Market of Bursa Malaysia Securities Berhad (“Bursa Securities”).

JS Solar, through its subsidiaries (collectively known as the “Group”), principally delivers comprehensive engineering, procurement, construction, and commissioning (“EPCC”) and contracting services for solar PV systems, complemented by operations and maintenance (“O&M”) services.

The Group has successfully delivered solar PV projects spanning residential, commercial and industrial (“C&I”) properties, and utility-scale projects, with a diverse portfolio that includes ground-mounted, floating, and rooftop solar PV systems.

Managing Director of JS Solar, Mr. Johnson Chai Jeun Sian (蔡振贤先生) said, “The launch of our prospectus today marks a key milestone for JS Solar as we move into the next phase of our growth. Backed by a solid track record, we are well-positioned to expand our operations across Peninsular Malaysia and Sabah. The IPO proceeds are earmarked for among others, our business expansion and strengthening our market presence in the solar PV industry.”

In line with the national agenda to increase the renewable energy capacity to 70% by 2050, the Malaysian Government is intensifying efforts to drive wider adoption of solar PV systems. This policy direction has not only spurred stronger demand for solar energy solutions but has also accelerated the need for supporting technologies such as the Battery Energy Storage Systems (“BESS”), which play an essential role in ensuring grid stability and energy efficiency in a solar-powered ecosystem.

“BESS is a cutting-edge solution that stores surplus electricity, particularly from renewable sources, during off-peak periods and discharges it during high demand, improving grid stability and reducing dependence on fossil fuels. We see significant potential in this technology and have completed a BESS project, which marks our entry JS Solar Holding Berhad as a main contractor in this technology. We are confident that JS Solar will continue to serve as a trusted strategic partner in driving future BESS development.”

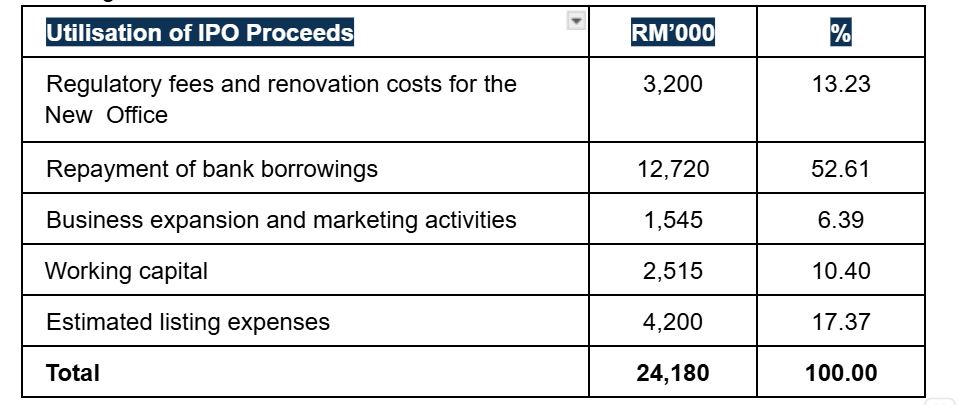

As at 31 July 2025, the Group recorded an unbilled order book of RM39.74 million, comprising RM34.33 million from EPCC services, RM3.49 million from contracting services for utility-scale projects, and RM1.93 million from O&M services. The expected RM24.18 million IPO proceeds to be raised are set to be utilised in the following manner:

The IPO exercise entails a public issue of 78.00 million new ordinary shares in the Company (“Issue Shares”), representing 24.00% of its enlarged issued share capital, as well as an offer for sale of 19.50 million existing shares in the Company (“Offer Shares”), representing 6.00% of the enlarged issued share capital.

Out of the 78.00 million Issue Shares, 16.25 million Issue Shares will be made available to the Malaysian Public via balloting; 19.50 million Issue Shares to eligible directors, employees, and other persons who have contributed to the success of the Group (“Pink Form Allocation”); and the remaining 42.25 million Issue Shares will be made available by way of private placement to selected investors. The 19.50 million Offer Shares will be made available by way of private placement to selected investors.

JS Solar’s revenue grew from RM70.27 million in the financial year ended 31 March 2023 (“FYE 2023”) to RM186.53 million in the financial year ended 31 March 2025 (“FYE 2025”). This was supported by delivery of major projects such as the 50 MWac Kulim Hi-Tech Park (“KHTP”) Project and the 5.9 MWac Tawau Project, along with

steady contributions from EPCC services for C&I projects. In line with this growth, the Group’s profit after tax increased from RM0.96 million to RM8.00 million over the same period, representing a compound annual growth rate of 188.7%.

JS Solar Holding Berhad

Upon listing, JS Solar is expected will have a market capitalisation of RM100.75 million, based on its enlarged issued share capital of 325.00 million shares and an IPO price of RM0.31 per share.

Following the prospectus launch, applications for the public issue are open from today and will be closed on 9 September 2025 at 5:00 pm. The Group is scheduled to be listed on the ACE Market of Bursa Securities on 23 September 2025.

TA Securities serves as the Principal Adviser, Sponsor, Underwriter and Placement Agent, while Eco Asia Capital Advisory Sdn Bhd serves as the Financial Adviser for the IPO exercise.