Generator rental services provider, Express Powerr Solutions (M) Bhd (“Express Powerr” or the “Company”) (迅行电源方案有限公司), has successfully launched its prospectus today in conjunction with its upcoming initial public offering (“IPO”) and listing on the ACE Market of Bursa Malaysia Securities Berhad (“Bursa Securities”).

Photo caption (From left to right)

- Encik Rosli Bin Jonid, Non-Independent Executive Director of Express Powerr Solutions (M) Bhd

- Mr. Lim Cheng Ten (林青田先生), Managing Director of Express Powerr Solutions (M) Bhd

- Yang Berbahagia Dato’ Mohd Redza Shah Bin Abdul Wahid, Independent Non-Executive Chairman of Express Powerr Solutions (M) Bhd

- Mr. Jamieson Chew Yen Loong (周元龍先生), Director of Mercury Securities Sdn Bhd

- Mr. Eric Chong Soo Keng (张斯钦先生), Head of Corporate Finance of Mercury Securities Sdn Bhd

Headquartered in Klang, Express Powerr, through its subsidiary (collectively, known as the “Group”), has built a solid reputation as a provider of generator rental services. With a 20-year track record, the Group provides reliable power solutions in emergency situations, during planned maintenance shutdowns, and as standby power for events. To meet the varied requirements of its customers, the Group also supplies ancillary items such as distribution boards, generator synchronisation panels, transformers, switchgears, load banks and cables.

The Group owns a fleet of 115 generator units across various capacities, where 70% of the fleet consists of mobile generators mounted on trucks, allowing deployment to various locations. Notably, nearly 75% of the fleet consists of large-sized generators with power capacities of 500 kilovolt-ampere (“kVA”) and above, making them well suited for high-demand applications.

Backed by its dependable and high-quality services, Express Powerr counts Tenaga Nasional Berhad and Sabah Electricity Sdn Bhd among its customers, both directly and indirectly. Beyond utilities sector, the Group also caters to a broad range of industries, including mechanical and electrical, manufacturing, and construction companies, as well as event organisers and government agencies.

Over the years, the Group has strengthened its presence across Malaysia, expanding to new states with entry into Sabah in 2024, followed by Penang and Kelantan in 2025.

Managing Director of Express Powerr, Mr. Lim Cheng Ten (林青田先生), said “The launch of our prospectus marks a pivotal step towards our listing on the ACE Market of Bursa Securities. We are ready to embark on the next phase of growth by expanding our fleet of generators, broadening our customer base, and geographical coverage.”

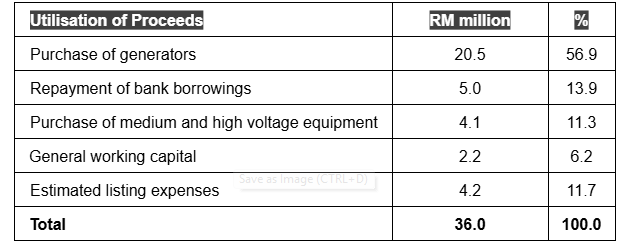

The RM36.0 million expected proceeds to be raised from the IPO are set to be utilised in the following manner:

“The funds raised from our IPO will enable us to expand our fleet by at least 36 units and acquire medium and high-voltage equipment to complement this expansion. This will strengthen our ability to serve a wider customer base, particularly in the northern region. Part of the proceeds will be used to repay borrowings taken to partially finance our new headquarters and operations yard, providing a strong foundation for continued growth.”

The IPO exercise involves the public issuance of 180.0 million new ordinary shares (“Issue Shares”), representing 19.3% of the Group’s enlarged issued share capital, as well as an offer for sale of 65.4 million existing shares (“Offer Shares”), or 7.0% of its enlarged share capital.

Of the 180.0 million Issue Shares, 46.7 million Issue Shares will be made available to the Malaysian public via balloting, and 18.7 million Issue Shares to its eligible directors,

EXPRESS POWERR SOLUTIONS (M) BHD Registration No. 202301027296 (1521219-K)

employees and persons who have contributed to the success of the Group (“Pink Form Allocations”). The remaining 63.2 million Issue Shares and 51.4 million Issue Shares will be made available by way of private placement to selected investors, and to Bumiputera investors approved by the Ministry of Investment, Trade and Industry (“MITI”), respectively. Meanwhile, 65.4 million Offer Shares will be made available by way of private placement to Bumiputera investors approved by the MITI.

Express Powerr will have a market capitalisation of RM186.9 million upon listing based on an enlarged issued share capital of 934.4 million shares and an IPO price of RM0.20 per share.

For the financial year ended 31 December 2024 (“FYE 2024”), the Group’s revenue grew to RM70.2 million from RM19.3 million recorded in financial year ended 31 December 2021 (“FYE 2021”), reflecting a 3-year compound annual growth rate (“CAGR”) of 53.7%. In tandem with the higher revenue, net profit saw a CAGR of 43.1%

to RM16.6 million from RM5.7 million over the same period.

For FYE 2024, revenue was primarily driven by planned maintenance services, which accounted for 61.8% of total revenue, followed by emergency services at 35.6% and standby services at 2.6%.

For the financial period ended 31 March 2025 (“FPE 2025”), Express Powerr’s revenue grew 8.9% year-on-year (“YoY”) to RM12.9 million from RM11.8 million a year ago. Concurrently, net profit rose 16.9% YoY to RM2.9 million from RM2.5 million.

Following the prospectus launch, applications for the public issue are open from today and will be closed on 8 September 2025 at 5:00 pm. Express Powerr is scheduled to be listed on the ACE Market of Bursa Securities by 24 September 2025.

Mercury Securities serves as the Principal Adviser, Sponsor, Sole Underwriter and Sole Placement Agent for the IPO exercise.